Introduction

India’s capital markets have witnessed a surge of IPO-bound companies, especially in the fintech and wealth management sector. One of the most closely tracked names is Billionbrains Garage Ventures Limited, better known as Groww. The company’s SEBI filing signals a major step towards its upcoming IPO, making it a critical opportunity for investors tracking unlisted shares in India.

About the Company

Billionbrains Garage Ventures Limited was incorporated in 2018 and has quickly risen to prominence as the parent entity of Groww, one of India’s leading investment and wealth management platforms. Following the merger with Groww Inc. in 2024, the company transitioned into a public limited entity in 2025. Promoted by Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh, Groww has disrupted traditional investing by making mutual funds, equities, and other financial products accessible to millions of retail investors.

Financial Overview

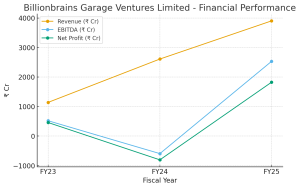

The company’s restated consolidated financials reflect significant growth in revenues and profitability. Below is a summary of the last three fiscal years:

| Fiscal Year | Revenue (₹ Cr) | EBITDA (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|---|

| 2023 | 1,141.53 | 518.21 | 457.72 |

| 2024 | 2,609.28 | -594.17 | 805.45 |

| 2025 | 3,901.72 | 2,531.00 | 1,824.37 |

Market Position & Opportunities

The Indian investment and wealth management industry is projected to expand at a CAGR of over 20% in the coming years. Groww has positioned itself as a digital-first platform catering to retail investors, offering simplicity, transparency, and trust. Key differentiators include its intuitive app interface, diversified product offerings, and strong backing from global investors like Peak XV Partners, YC Holdings, and Ribbit Capital.

The graph shows the financial performance of Billionbrains Garage Ventures over three fiscal years (2023–2025)

✅ Key Insight: Revenue, EBITDA, and Net Profit all show accelerated growth, indicating the company is expanding rapidly and improving margins.

The graph reflects robust financial growth, with revenue crossing ₹3,901.72 Cr by FY25 and net profit reaching ₹1,824.37 Cr. With strong fundamentals, Billionbrains Garage Ventures Limited’s IPO looks attractive for growth-focused investors, especially in the AI & SaaS sector.

Risks & Challenges

Investors should carefully evaluate the following risks highlighted in the SEBI filing:

– Regulatory risks from evolving SEBI guidelines.

– Market volatility affecting AUM growth and investor participation.

– High competition from other fintech platforms such as Zerodha and Upstox.

– Dependence on continuous technological upgrades and data security compliance.

Investment Insights

For investors, Billionbrains Garage Ventures presents both short-term and long-term opportunities. While listing gains may be driven by strong brand recognition, the company’s real potential lies in sustained AUM growth, expansion into new financial services, and capturing India’s under-penetrated retail investment market.

Billionbrains Garage Ventures Unlisted Share Price

Currently, Billionbrains Garage Ventures’ unlisted shares are being tracked actively in the grey market. Investors searching for upcoming unlisted shares in India view Groww as one of the most promising opportunities. The price dynamics of these unlisted shares often reflect the high demand in anticipation of its IPO.

Conclusion

Billionbrains Garage Ventures Limited represents a landmark opportunity in India’s fintech evolution. Its IPO is set to be a major event in the unlisted shares market, and investors should stay tuned for updates on Unlisted Radar.

Billionbrains Garage Ventures Limited – FAQs

1. What is Billionbrains Garage Ventures’s unlisted share price today?

The SEBI filing does not mention any live unlisted share price. Such prices are determined in the grey/unlisted market and are not officially disclosed in the prospectus.

2. How to buy Billionbrains Garage Ventures unlisted shares?

The prospectus does not provide details on unlisted share transactions. These typically happen via SEBI-registered intermediaries and brokers specializing in unlisted shares before IPO.

3. Is Billionbrains Garage Ventures a good investment before IPO?

The filing outlines the company’s strong growth in revenues, profitability, and brand position, but also highlights risks like regulatory changes and competition. Whether it’s a good investment depends on investor risk appetite and grey market valuations.

4. When will Billionbrains Garage Ventures IPO launch?

The Updated Draft Red Herring Prospectus (UDRHP) filed on September 16, 2025 lists the proposed IPO, but the exact Bid/Offer opening and closing dates are still .

The final schedule will be published after SEBI approval and RHP filing.

5. What are the risks of investing in Billionbrains Garage Ventures unlisted shares?

The Risk Factors section highlights:

– Regulatory risk from SEBI compliance and frequent changes.

– Operational risk due to dependence on technology and data security.

– Market risk from volatility in retail investor participation.

– Competitive risk from peers like Zerodha and Upstox.

6. Which brokers deal in Billionbrains Garage Ventures unlisted shares?

The SEBI filing doesn’t list brokers for unlisted trading. In practice, grey market trades happen via specialized dealers in the unlisted market, not through the official IPO syndicate.

7. What is the lot size in the IPO?

The lot size is not finalized yet. The prospectus mentions that the minimum bid lot and price band will be published at least 2 working days before the IPO opens.

8. How does Billionbrains Garage Ventures compare with competitors?

According to the Redseer industry report included in the filing, Groww (Billionbrains) is positioned among the top fintech investment platforms in India, competing with Zerodha, Upstox, and Paytm Money. Its differentiators include a retail-first model, simplified interface, and strong investor backing.